Why We Invested: Udhaar Book

This is the third installment of our new Why We Invested series, where we’ll go into every investment we make from Fund II and talk about the problems that our portfolio companies are addressing, and what they’re doing about it. (You can find installment one, about Wagely, and installment two, about Naluri, here). Our analyst Theodore draws in his spare time, and so we chose to capture a lot of the ideas about what these companies are up to using art instead of text.

But for the third installment, we wanted to do things a little differently, and delve a little deeper into the data. (Brace yourselves, we are geeking out on data with this one. For those of you who understandably have better things to do, feel free to skip to the summary at the end.)

A few months ago, Integra invested a tiny check in the pre-Y Combinator W21 Demo Day round of Udhaar Book. Fahad and Shah are building the Khatabook of Pakistan, helping micro SMEs across the country to digitize their bookkeeping. While we would have loved to invest more, we didn’t have much time to make a decision. And so we really made our initial investment on the merits of the market opportunity. But a few months after that round closed, Udhaar Book’s growth outstripped all expectations, and Fahad and Shah decided to accelerate their next round of funding. This time, we had plenty of time to get to know the company, and we participated via Integra Partners Fund II in a much more significant way.

For this article, we’ll cover:

- The market opportunity: Why digitization is so important

- The market opportunity: Why digitization is so difficult

- What the data tells us

- The investment counterargument

- Summing up the big picture

The Market Opportunity: Why Digitization Is So Important

Pakistan’s households are powered by kirana stores — the kind of corner shop where you can pick up a sack of rice, a box of detergent, or a pound of sugar. They’re the same stores you’ll find in other countries across the world — kiranas in India, sari-sari stores in the Philippines, warungs in Indonesia. Usually they’re a simple storefront manned by a guy wielding stacks of paper, tracking everything from inventory to payroll to what the regulars owe for their weekly shopping. Kind of like this:

The basic reasons for digitizing these stores are obvious. Papers get lost, record-keeping is messy and time-consuming, and transactions are cash-based, which also creates a massive security headache for the store owner. Digitization is a huge source of efficiency; efficiency brings down the costs of serving a customer; and service cost (i.e profitability) is a huge factor in who does and does not get included in the formal financial system. More importantly, there’s the issue of data reliability, which is another huge reason why businesses that run on cash and paper are much more likely to be excluded from the financial system and the digital economy. Only about 178,000 of the larger and more formal SMEs in Pakistan are able to access financing, compared to an estimated total of 32 million (which includes informal and micro businesses). Here, we illustrate the scale of the problem:

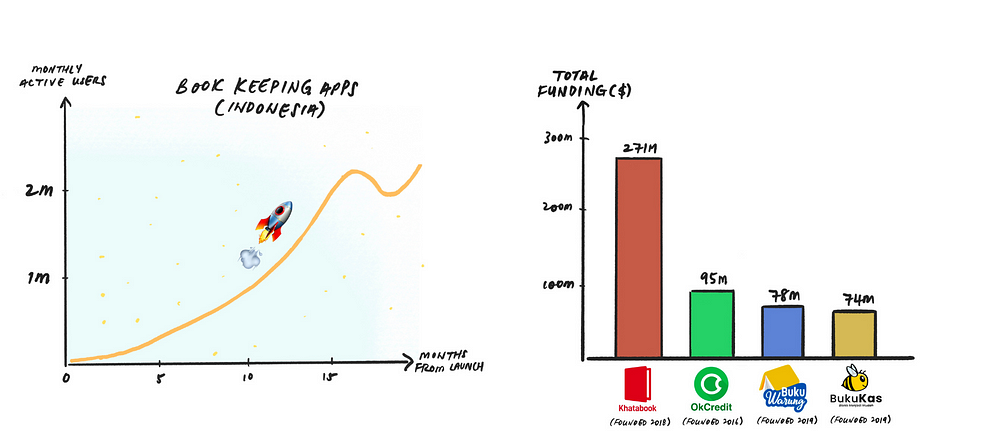

Of course, huge problems = huge opportunities. In recent years, easy-to-use smartphone apps that help storekeepers to keep track of their bookkeeping have sprouted up in many emerging markets — Khatabook and OKCredit in India, and Bukukas and Bukuwarung in Indonesia, to name a few. Their rates of growth have been impressive, and equally, all have raised impressive rounds of VC funding:

The Market Opportunity: Why Digitization Is So Difficult

All this makes Udhaar Book seem like a slam dunk so far, but those rates of growth from peer apps belie the difficulty of digitizing a segment that is notoriously resistant to digitization and relatively new to smartphones. Anyone who functions as their family’s IT consultant can relate to this.

The fintech landscape in Southeast Asia is littered with examples of companies that struggle or have struggled to bring digitization to the underserved masses: Customers who show up to a startup’s office, cash in hand, to repay their credit lines; startups whose confused customers resort to calling their sales rep to physically show up to input their data into the app for them every single time they needed to complete a simple transaction; startups who claim to be “digitizing XYZ” but are really a fancy website on top of an Excel spreadsheet and a huge team of underpaid call center staffers / feet-on-the-street soldiers. Some of these startups manage to push through their teething problems; others fail to achieve more than linear scaling and eventually fold. Stories like these make digitization seem like an uninteresting buzzword from 2010: half the time, digitization appears to have already been accomplished, and the other half of the time, digitization seems like a trivial layer on top of a stubbornly manual process. The real point is that in emerging markets, digitization has been unevenly distributed across different sectors in different countries.

What the Data Tells Us

So let’s talk about what Udhaar Book is doing in Pakistan. Like its counterparts in India and Indonesia, it bases its core product around a simple app that requires habit-forming, repeated interaction — a credit ledger that records what customers owe and that sends payment reminders. Much more has been added as the product evolves — inventory management, payroll management, digital payments, mobile recharge, bill payments, and more.

Like its counterparts, it has demonstrated impressive rates of growth. Here’s a rough representation of what Udhaar Book’s monthly transacting user (MTU) chart looks like month on month in the last 12 months:

Here’s a rough representation of what the rate of growth of its highly engaged users looks like:

While MAUs have grown ~10x, its power users have grown >12x over the same period. This tells us that the company has been getting better and better at targeting its power audience, and that its power audience is getting to be a larger and larger proportion of its overall user base.

The transaction volume being recorded on Udhaar Book’s apps tell the same story. Here’s a rough representation of what that looks like on a monthly basis.

As of this writing, annualized GTV flowing through Udhaar Book’s apps is exceeding $7.4b.

The fundamental question that we are asking of the data, though, is whether or not Udhaar Book is habit-forming. In other words, are these merely vanity metrics that Udhaar Book is reporting, or are they actually helping their customers to digitize in a non-trivial way?

Here’s Udhaar Book’s cohort retention chart for its power users (on the right), for its Aug 2020, Mar 2021, and Jun 2021 cohorts. You’ll wonder if we cherry-picked these cohorts but there are reasons behind them — Aug 2020 is the first month that data is available, Mar 2021 was Udhaar Book’s YC graduation month, and Jun 2021 is the most recent month that has reached at least M4 (M0 for that cohort being June 2021, and M4 being October 2021).

You’ll see that all three cohorts show an initial dropoff between M0 and M1. This is expected — some users will download the app and then never open it again. But the curves also show that once a cohort reaches its third or fourth month, its size remains more or less stable. What’s even better is that these curves “smile” — i.e., even older cohorts start growing again. Lastly, retention gets much better across cohorts — June 2021’s M4 retention is much better than August 2020’s M4 retention, for example.

So Udhaar Book can retain users, and they’ve found a core of power users and have gotten better at targeting them. But are users using it more over time? Let’s take a look at Udhaar Book’s transaction count cohort data:

We’ll stick with the power users so we don’t have to keep repeating ourselves. (Overall user trends are directionally the same, except with lower user intensity, as you’d expect — but the interesting thing to note is that across all cohorts and all users (power and non-power), we see transaction retention hitting over 100%). So, Udhaar Book is habit forming. It’s worth putting this data in the context of the real world. In the beginning, users are loading the app maybe a few times a week, maybe just to input major transactions (say a customer who racked up an unusually large bill), or maybe to summarize everything that had been jotted down on paper that day into a single transaction. But over time, they get into the habit of relying on the app more and more.

The following charts help illustrate the point further. Across Udhaar Book’s user base, GMV per user is going up — indicating that Udhaar Book is helping users grow their revenues.

The Investment Counterargument

To be fair, Udhaar Book isn’t the only company in Pakistan aiming to digitize the country’s micro SMEs. Other countries where bookkeeping apps have flourished usually each have 2–3 leading players; there’s no reason to expect that Pakistan won’t be the same way. There’s CreditBook and DigiKhata, both of which were founded around the same time, and EasyKhata, which is the bookkeeping app launched by the same team behind B2B e-commerce app, Bazaar. Then there’s the apps that offer different services but target the same audience, like the aforementioned Bazaar, as well as Bazaar’s direct competitor, Tajir. So Udhaar Book is definitely swimming in some competitive waters. For now, in our totally (un?)biased opinion, Udhaar Book’s product is richer and more evolved than its direct peers, but there’s no reason to believe that the others can’t follow. So Udhaar Book is going to have to keep being excellent at understanding how its customers’ wants and needs evolve, and at meeting them.

That’s not the only risk that Udhaar Book faces; like its counterparts in other countries, it has yet to charge its customers any significant fees for using its app. That’s typical of startups at Udhaar Book’s stage — but at some point down the road, investors will want to see real revenue and not just monetization potential. Notably, though, the Udhaar Book team has already successfully activated monetization across pilot segments, which is a strong signal that they have found a user base that not only sees value in what Udhaar Book delivers, but is willing to pay for it.

And lastly — and this is always downside to doing business in quote-unquote “exotic” places — not every investor is willing and ready to take the risk of investing in Pakistan, and those that do so now may not stick around when the going gets tough. That is a risk for companies like Udhaar Book, which will need to continue raising capital to grow. The upside, of course, of doing business in these markets is that the opportunity set is huge and the rewards large for those who are successful at tackling it.

Summing Up The Big Picture

And ultimately, that’s the point. When you successfully digitize a small business, like so:

and then the next one, and the next one, and the next one, until you create a nationwide network of them…

…the possibilities are endless. The data tells us that Udhaar Book has found a core audience of SMEs that want their help to make the switch. For them, Udhaar Book has lots up its sleeve that it doesn’t want to talk about yet, but watch this space.

Written by Jennifer Ho, Partner at Integra Partners. Illustrated by Theodore Ng.